Greetings to everyone who is interested in the Quicktoken platform! Today, as promised, we will cover the redemption procedure for token packages, the issue and the secondary market for which has been described in the previous two announcements.

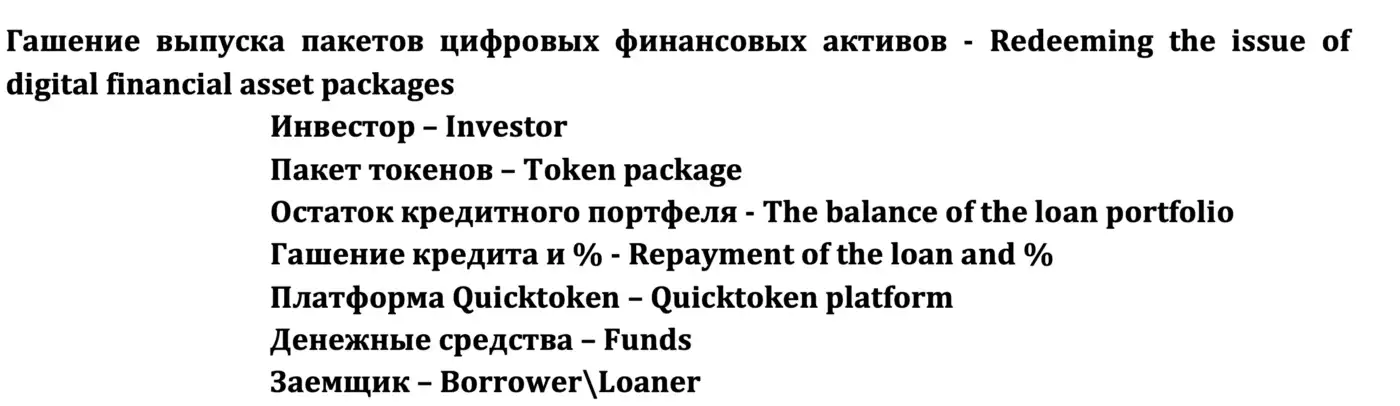

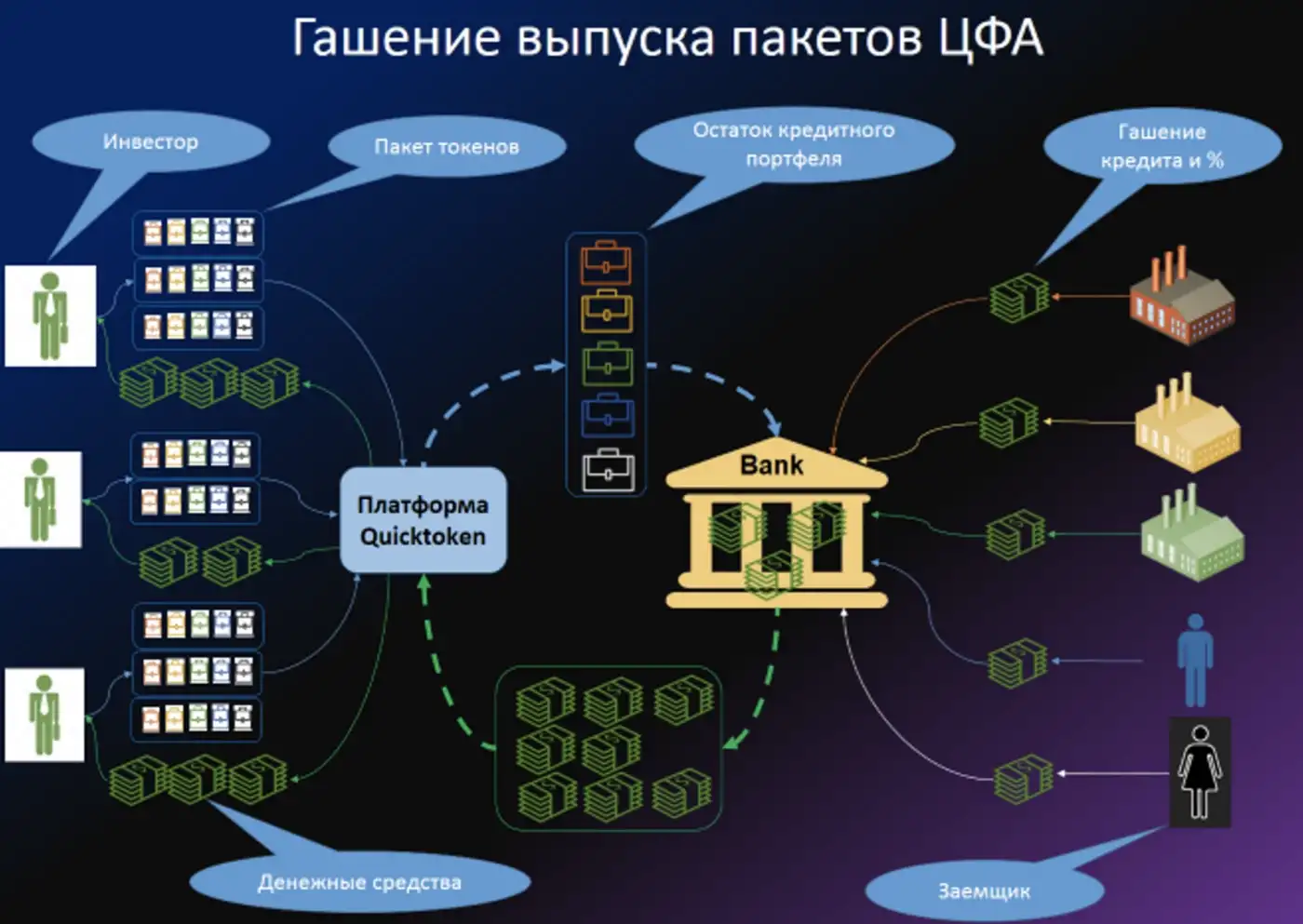

The redemption process is shown schematically on the slide.

The redemption process is shown schematically on the slide.

Once a bank has sold a portfolio of loans to investors through the Quicktoken platform. The servicing of those loans (i.e. receipt of funds, control of collateral, etc.) remains with the bank. The only difference is that the bank now performs all these functions as an intermediary — for the benefit of the investors who purchased the tokenized portfolio.

How the Quicktoken platform works — redemption of token packages

5K

April 9

The funds collected from the borrowers are transferred to the platform by the bank at the time of redemption of the tokenized portfolio. The investors, at the time they redeem the token packages, transfer the token packages they own to the platform. The platform “collects” the loans from the received tokens and sells these loans to the Bank on pre-agreed terms. The platform transfers the funds received from the Bank to the investors from whom it has received the token packages.

The Bank can then re-tokenize the redeemed loans (taking into account their current status at the time of the new tokenization) and add new loans to the portfolio and re-allocate the token packages to investors using the Quicktoken platform.

As the astute reader has surely noticed, the bank’s work has not become any less. The bank still accompanies borrowers from the moment the loan is issued until it is repaid. However, the risk of the loan is no longer with the bank, but with the investors who purchase the token packages. This allows the bank (without regard to regulations that limit the growth of the loan portfolio to the bank’s capital) to make more and more loans, of course, immediately selling them to investors in the form of token packages.

As a result, the bank’s profits grow, more borrowers receive loans, and more investors place their funds on the Quicktoken platform. The more investors on the platform, the higher the liquidity of the token packages. This means that the package yield that would suit investors in such an instrument is reduced. A decrease in the rate of return on token packages in turn leads to a decrease in the rate on loans made, which means that loans become more attractive for borrowers.

Now that we have reviewed and discussed with you all the features of the new financial instrument, which is formed on the Quicktoken platform, we are sure that you, like us, have no doubts about the success of the project.

See you soon!

The Bank can then re-tokenize the redeemed loans (taking into account their current status at the time of the new tokenization) and add new loans to the portfolio and re-allocate the token packages to investors using the Quicktoken platform.

As the astute reader has surely noticed, the bank’s work has not become any less. The bank still accompanies borrowers from the moment the loan is issued until it is repaid. However, the risk of the loan is no longer with the bank, but with the investors who purchase the token packages. This allows the bank (without regard to regulations that limit the growth of the loan portfolio to the bank’s capital) to make more and more loans, of course, immediately selling them to investors in the form of token packages.

As a result, the bank’s profits grow, more borrowers receive loans, and more investors place their funds on the Quicktoken platform. The more investors on the platform, the higher the liquidity of the token packages. This means that the package yield that would suit investors in such an instrument is reduced. A decrease in the rate of return on token packages in turn leads to a decrease in the rate on loans made, which means that loans become more attractive for borrowers.

Now that we have reviewed and discussed with you all the features of the new financial instrument, which is formed on the Quicktoken platform, we are sure that you, like us, have no doubts about the success of the project.

See you soon!

Twitter