Quicktoken welcomes you! Today, let’s discuss our approach to tokenization.

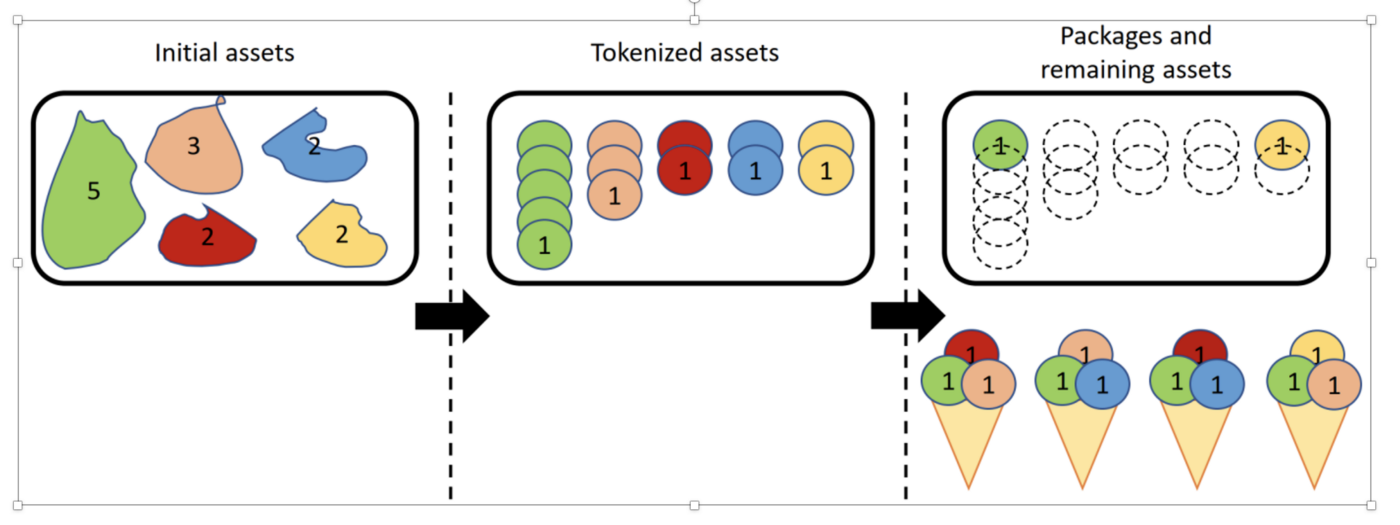

Let’s start with ice cream! Let initial financial assets of different values be given — flavors of ice cream, each with its own mass. The assets are tokenized so that they have the same value in each individual token — balls of ice cream of the same mass are formed. The tokens are grouped into packages with given properties (the optimal portfolio sale problem is solved) — the balls are distributed into cups, for example, so that all the flavors in each ice cream are different. A similar design is applicable to various financial assets, e.g. bank loan portfolios.

Let’s start with ice cream! Let initial financial assets of different values be given — flavors of ice cream, each with its own mass. The assets are tokenized so that they have the same value in each individual token — balls of ice cream of the same mass are formed. The tokens are grouped into packages with given properties (the optimal portfolio sale problem is solved) — the balls are distributed into cups, for example, so that all the flavors in each ice cream are different. A similar design is applicable to various financial assets, e.g. bank loan portfolios.

A new kind of token for the Quicktoken platform

7K

May 10

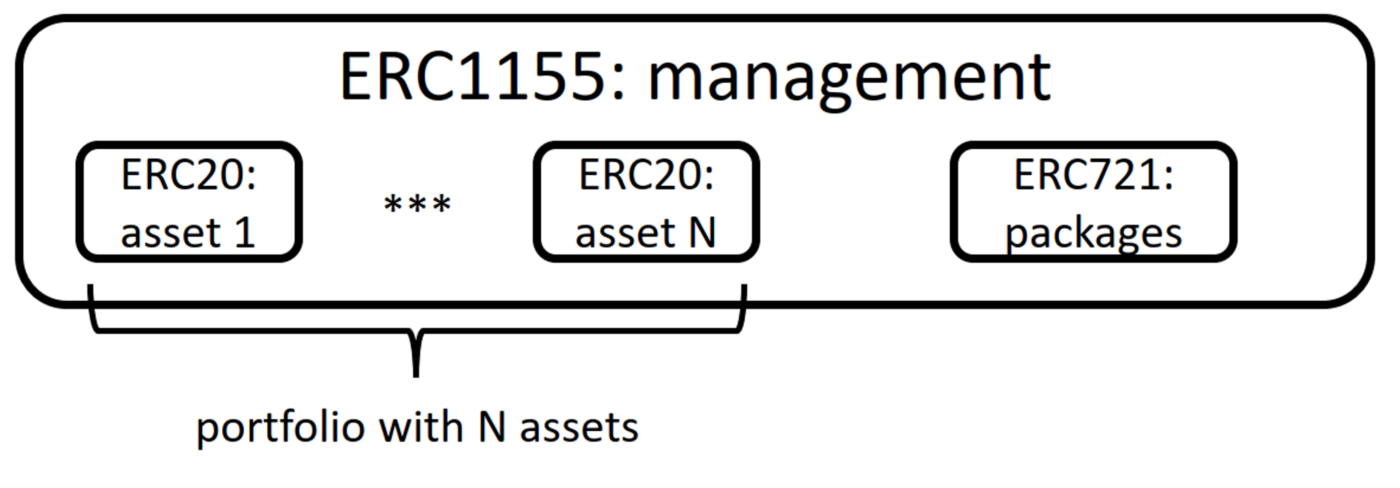

A smart contract for tokenization is designed to perform the two-step procedure described above digitally. The portfolio holder deploys a smart contract to manage the tokenization. The contract deals with different types of tokens and can be based on ERC1155. The portfolio owner creates a digital twin for each asset in the portfolio. We assume that the value of the assets is in the owner’s base currency, e.g. USD. All equal parts of each individual asset’s value are fungible, as is the base currency. Thus, the initial tokenization creates a fungible token type for each asset, the number of tokens equals the value of the assets, and no additional issuance is allowed.

Issuing an ERC20 token per asset covers the needs of the first step. The second step is to solve the problem of allocating tokens to the packages (optimal portfolio sale) and write it to the blockchain. Packages have the same properties, i.e. they are exchange-traded commodities. However, each package keeps matching specific parts of the initial assets, so they are non-fungible (NFT). A single ERC721 is sufficient to satisfy the second step: the portfolio owner determines the number of packages and timestamps their contents when creating the contract. All ERC20 and ERC721 are managed in ERC1155 to ensure system consistency.

As a result, our architecture for tokenization consists of one ERC1155 smart contract at the top level, ERC20 smart contracts by number of initial assets for the first phase, and one ERC721 for the second phase.

In the next announcement, we will look at the task of generating packages — the optimal portfolio sell-off task.

In the next announcement, we will look at the task of generating packages — the optimal portfolio sell-off task.

Twitter